Religion

Related: About this forumFlorida church violated its religious exemption status and got slapped with a $7.1 million tax bill

The church, located at 609 Brickell Ave., has run a K-8 religious school on the property since 2008. The bill comprises a tax lien totaling $6.5 million (including interest and fines) for the years 2009-2017 and a current bill of $509,526.24 for the 2018 year.

http://deadstate.org/florida-church-violated-its-religious-exemption-status-so-it-got-slapped-with-a-7-1-million-tax-bill/

Oh my!

marble falls

(62,047 posts)“The property appraiser is doing their job and we are doing ours,” he said. “The rest is in the hands of God.” and the tax lawyers apparently.

Oppaloopa

(896 posts)THAT is where they need to investigate!!!!!!

All of them need to be investigated, not just one group!!!

AC_Mem

(1,979 posts)however, Scientology is a really dangerous Cult - if there is a list of who needs to be investigated, they need to be at the top.

Sancho

(9,103 posts)Racerdog1

(808 posts)These cults acting and pretending to be churches are nothing but a high form of fraudsters.

RKP5637

(67,112 posts)Larrybanal

(227 posts)Soxfan58

(3,479 posts)For preaching right wing politics.

Lonestarblue

(11,814 posts)I’ve always seen the tax exemption for churches as forced subsidies of religion, especially now that evangelicals are so heavily involved in politics. If ministers can tell parishioners who to vote for, those churches should lose their exemption.

catbyte

(35,764 posts)From the IRS website:

In 1954, Congress approved an amendment by Sen. Lyndon Johnson to prohibit 501(c)(3) organizations, which includes charities and churches, from engaging in any political campaign activity. To the extent Congress has revisited the ban over the years, it has in fact strengthened the ban. The most recent change came in 1987 when Congress amended the language to clarify that the prohibition also applies to statements opposing candidates.

Currently, the law prohibits political campaign activity by charities and churches by defining a 501(c)(3) organization as one "which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office."

https://www.irs.gov/newsroom/charities-churches-and-politics

RKP5637

(67,112 posts)Crutchez_CuiBono

(7,725 posts)so that churches could preach politics and not lose their tax empt status. Not positive, but, I think thats been changed. I don't have a link, and i may be wrong. Seems like it was in one of their very first bills.

mwb970

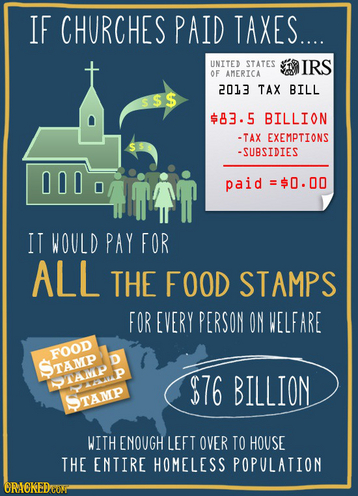

(11,700 posts)The "no taxes for churches" BS has got to end. We are moving past religion now.

Ferrets are Cool

(21,957 posts)RKP5637

(67,112 posts)people hand over their money for the imaginary being in the sky.

mountain grammy

(27,271 posts)greymattermom

(5,794 posts)and maybe they will actually help the poor. If they operate a soup kitchen, they would get reduced property tax, for example. It's easy to figure out how this would work.

lostnfound

(16,634 posts)Wonder if someone was trying to buy it

Farmer-Rick

(11,399 posts)True that bill includes fines and interest and covers several years but it says in this year alone they have racked up over half a million.

How much income and property must they own to rack up that kind of cost in taxes alone?

Religion is a scam. If we gave that kind of assistance to farmers, we would all be eating organic, pesticide and Round Up free foods.

lostnfound

(16,634 posts)This is probably motivated by a politically connected developer that wants the property.

It’s probably going to be underwater (global warming) in 20 years anyway.

usaf-vet

(6,896 posts)Revaluate the justifications for maintaining 501C status.

If the church(s) are preaching politics from the pulpit on Sunday pull their status.

If they are funding political activities or candidates pull their status.

If the head of a mega church is living the life of a millionaire / billionaire pull their status.

No more million dollar jets and mega homes while people in their part of the state are struggling to support a family.

And on and on and on.... the many reasons that the tax exempt status is being miss used.

Major Nikon

(36,900 posts)Make churches qualify like all other non-profits. If you wanna run a soup kitchen, tax exempt. Fleecing the flock, not tax exempt.

usaf-vet

(6,896 posts)LittleGirl

(8,434 posts)NeoGreen

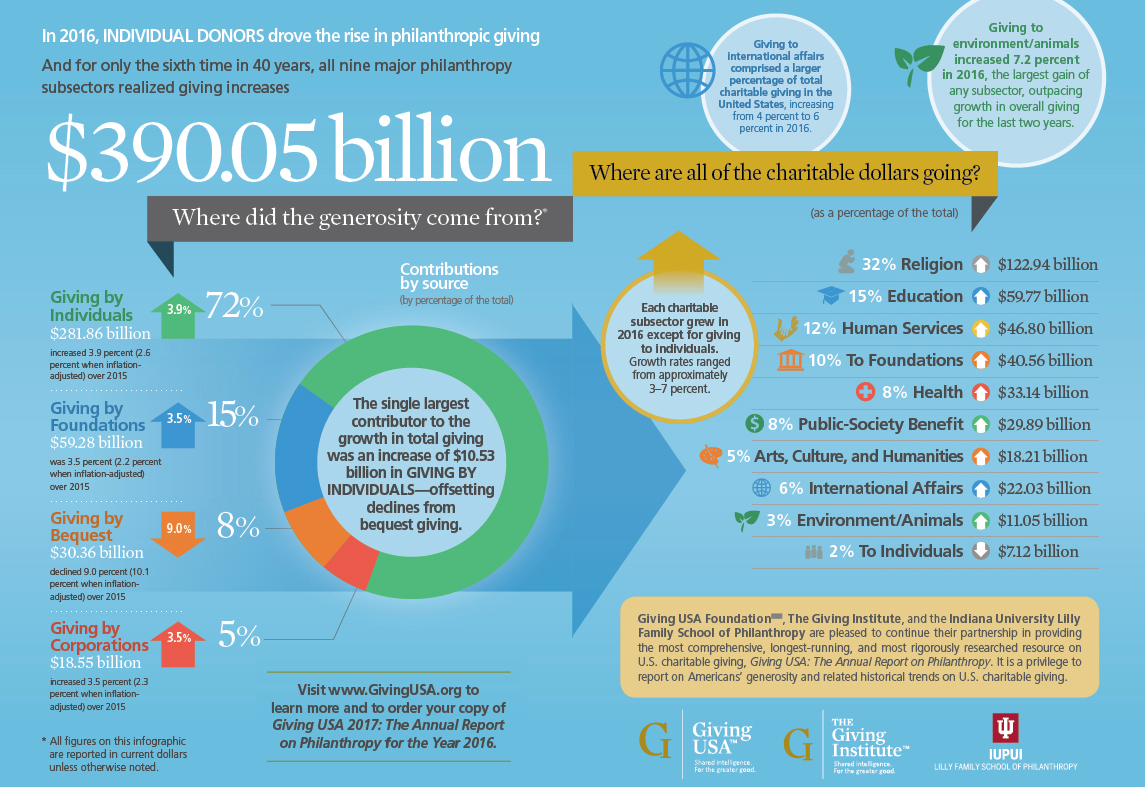

(4,033 posts)Food for thought,

LittleGirl

(8,434 posts)Nitram

(24,597 posts)MineralMan

(147,572 posts)We don't notice it, because we don't see how much taxes they would pay if they were not exempt. This is a good example of how much money that church essentially got from the county by not having to pay the taxes other properties have to pay.

This should be a wake-up call to people who live there. I'll bet that church is wide-awake today about what their violations mean to them. Pay up, folks. You were conducting commercial operations on that property, and are liable for those taxes.

End tax subsidies for all churches!

Hulk

(6,699 posts)If I were a congressman, I’d be working to introduce a bill designed to LIMIT the tax exemption for ANY non profit..Churches in particular. Mega churches can exist, but they WOULD BE TAXED on everything over a certain cap.

Non profits might be a little more complicated, but churches would be a no brainer. Property tax everything over $1-2,000,000 at the standard rate; income tax on everything same as a business.

Evangelical heads would explode. I’d be a one term congressman, but it needs to be addressed.

nitpicker

(7,153 posts)At least on not reporting the food truck income (iif not insignificant) on a 990-T.

The IRS has been much more reluctant to go after church school, because it could be construed as trying to make laws about what religious organizations can have as related businesses.