On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Last edited Thu Oct 19, 2023, 06:01 AM - Edit history (1)

I had just started a new job. The old timers saw a lot of money disappear that day. {ETA: on paper, as people noted. If they didn't have to sell right away, they came out okay.}

Black Monday (1987)

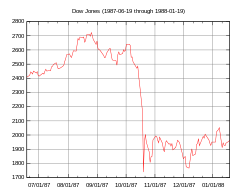

DJIA (June 19, 1987 to January 19, 1988)

Date: October 19, 1987

Type: Stock market crash

Outcome:

Dow Jones Industrial Average falls 508 points (22.6%), making it the largest one-day drop by percentage in the index's history.

Federal Reserve provides market liquidity to meet unprecedented demands for credit.

Dow Jones begins to recover in November 1987.

NYSE institutes rule regarding trading curbs in 1988.

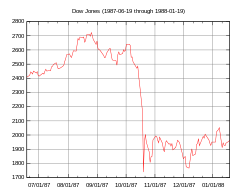

FTSE 100 Index of the London Stock Exchange (June 19, 1987 to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

The degree to which the stock market crashes spread to the wider economy ( or "real economy" ) was directly related to the monetary policy each nation pursued in response. The central banks of the United States, West Germany and Japan provided market liquidity to prevent debt defaults among financial institutions, and the impact on the real economy was relatively limited and short-lived. However, refusal to loosen monetary policy by the Reserve Bank of New Zealand had sharply negative and relatively long-term consequences for both financial markets and the real economy in New Zealand.

The crash of 1987 also altered implied volatility patterns that arise in pricing financial options. Equity options traded in American markets did not show a volatility smile before the crash but began showing one afterward.

{snip}

Sun Oct 15, 2023:

On this day, October 15, 2008, the DJIA dropped 733 points.

Wed Oct 19, 2022:

On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Sat Oct 15, 2022:

On this day, October 15, 2008, the DJIA dropped 733 points.

Tue Oct 19, 2021:

On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent

Thu Oct 15, 2020:

On October 19, 1987, Black Monday happened.