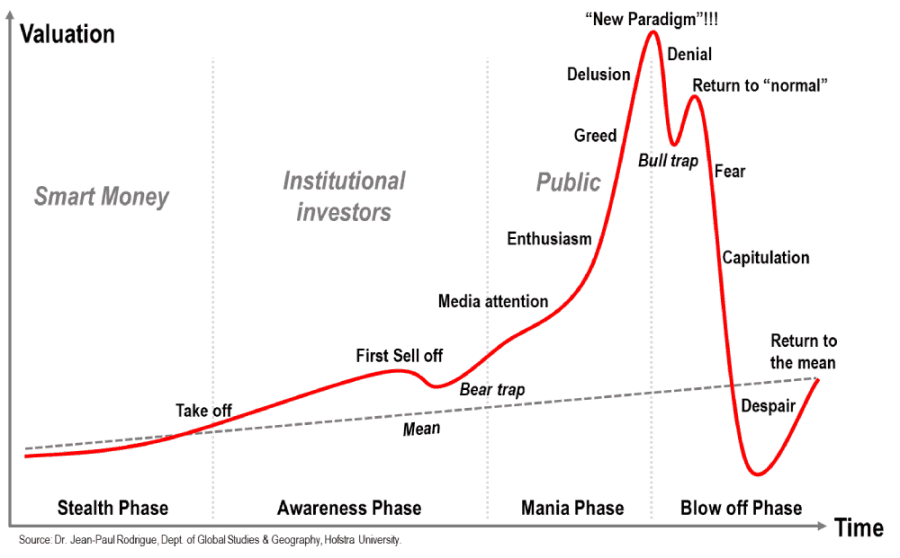

DJT Bull Trap?

The recent surge of DJT comes after the announcement of a phased rollout of a new streaming service they have developed and will begin scaling up. It seems to me the surge might be a bull trap. Many amateurs and cult members are over-awed by tRump and think he is a genius so they have invested in the company run by the incompetent inexperienced Devin Nunes ( {un}Truth Social).

I think the long term prospects of DJT are dismal, so the surge seems like an emotional reaction. There is support at 35, 40, and 50 dollars, but coming up from the underside, support levels can become resistance levels. $50 would be about a 60% retracement.

Hokie

(4,358 posts)If you are correct there is money to be made buying puts. What strike and expiration would you buy? (Hypothetically ![]() )

)

Bernardo de La Paz

(60,320 posts)Although I know the theory of puts, calls, naked puts, strangles, straddles, etc, I think the option players, especially in volatile stocks, have sharp tools for divining when they are overpriced / underpriced relative to all other options and the cost of money. When considering offsets and time periods and so on, it is too much for me.

If I were invested one way or another (long/short) I'd consider them as hedges, but I'm not touching DJT.

Celerity

(53,462 posts)Hokie

(4,358 posts)I am glad I didn't buy any puts. The price was in the mid 20s when I was looking. It's 40 now. A big turn off for me is the wide bid ask spread. For example the spread is 20% on most of the May 31 puts. That indicates to me there isn't much of a market in these options.

cliffside

(1,578 posts)"...The short-selling-prevention tips posted Wednesday on Trump Media’s website come as its DJT stock has fallen sharply in price since it began being public trading on March 26 — and as short sellers have taken a keen interest in the owner of the Truth Social app despite relatively high fees to finance such trades.

“It certainly shows concern” about short selling of Trump Media stock, said Kevin Murphy, a business professor at the University of Southern California who is an expert on executive compensation.

“I haven’t seen it before,” Murphy said when asked how common it is for companies to give shareholders instructions on how to thwart short sellers.

“Managers who ... think the stock is undervalued aren’t going to be overly concerned about short sellers,” he said..."

A HERETIC I AM

(24,840 posts)If you own shares of a given stock, the only way it could be loaned out to a short sale is if it is held in a margin account or a managed account that specifies it can be subject to loan. If you have a regular, vanilla investment account then any shares you own are not subject to this sort of transaction. Puts and short sales REQUIRE the ability to borrow shares from a margin or managed account from somewhere, to be repaid at a later date. That's how it works. You can not just simply sell short a stock out of the blue without a corresponding amount available to borrow. This goes for Options trades and regular short sales.

Short selling shares of DJT is currently limited or very expensive because of the limited float and the high premiums margin accounts are charging.

It isn't as if anyone can simply buy a shitload of Puts on DJT on the cheap and expect to get a massive windfall, or place a short sale on their account without holding the underlying shares.

It just doesn't work that way.

Hokie

(4,358 posts)I have dabbled a bit in options but mostly on calls. I thought you could buy puts w/o owning shares and sell them before expiration hopefully at profit if the stock price has dropped? the trouble I see with DJT is the lack of activity on options, the high implied volatility, and the wide bid ask spreads.

A HERETIC I AM

(24,840 posts)Also correct. You are buying the right, but not the obligation, to sell a stock at a given price on a future date. If you sell the contract before expiration, no actual shares have traded into or out of your account. If you use a platform like E*Trade or similar, on the Trade page you might have seen the selection "Buy to Cover". That's used for what you stated.

Yup. I had read where Trumpy himself is holding something like 60% of the float (if I remember correctly) and that has severely limited their availability.

I shouldn't have sounded so absolutist in my post, as there are very often work arounds, but some of them are skirting SEC rules.

May all your trades be net gains!

Bernardo de La Paz

(60,320 posts)$57.67 would be a 62% retracement from low of 22.55 to high of 79.38 (April and March respectively), for wave-theory friendlies.

Calculating in the logarithm domain, $49.08 would be a 0.618 (62%) retracement.

Best_man23

(5,267 posts)Last edited Thu May 9, 2024, 03:27 PM - Edit history (1)

This is a firm rule with regard to investing. And I think it goes without saying on this website that the tRump Organization has repeatedly and routinely engaged in "accounting irregularities."

Hard, hard pass on any investment (shares, options, etc.) in this "company".