I have never had a problem with the IRS until now. Need some advice

I submitted my tax return on March 19,2020. Got USPS tracking verification it arrived at the IRS on 3/23/2020. I filed a simple 1040-SR with a relatively small refund.

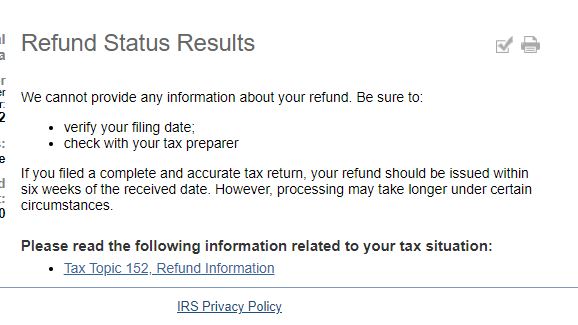

Usually it will take about 6 weeks or the latest 8 weeks for my refund to reach me. It's been exactly 8 weeks. No refund. I went onto the IRS web site, filled out the online status inquiry and the response I got back was they had no information on my return.

So now what? The only number I could find for the IRS 800-829-1040. That's just a voice version of the online inquiry form. It tells me the same thing. They can give me no information.

I checked for a local IRS office and it's an hour away and they have the same phone number. So now what?

I guess I'll wait another couple of weeks before I take any real action, but at this point I don't even know what action to take.

Any suggestions / advice?

Thanks

Cross posted in GD as not sure how much traffic this topic group gets.

safeinOhio

(35,417 posts)run for mayor. You’ll be covered.

pbmus

(12,467 posts)Hit by the Con and his cronies...thousands of agents were let go , they are anywhere between 2-6 weeks behind and in some cases many months....you will be lucky to hear something in another 2 weeks....more like another month or two![]()

elleng

(139,168 posts)Thomas Hurt

(13,931 posts)I filed mine online early in February and got mine in couple of weeks direct deposit.

Online just makes it much easier for me. If you can, you may want to try that.

Rorey

(8,514 posts)I actually haven't filed yet because I don't want to. ![]()

I will have to pay, so why hurry. I have, however, gone to the site to see if there's any info on my stimulus payment, and I get basically that same message that you're getting. They have no information on me.

I got a divorce last year and also have had to pay in for a lot of years, so they don't have any direct deposit info on me. I do get social security, so that entity has my bank information.

I'm sure eventually it'll all get figured out. (I'm kidding. I'm not sure of anything anymore.)

lastlib

(25,716 posts)This is the outfit that lost a million-dollar-plus check on the floor!

question everything

(50,021 posts)Try call your member of Congress. Even if he is a Trumpien, they like to brag how they help their constituents.

Yonnie3

(18,548 posts)Here is an article from a month ago that says they were just storing paper returns.

https://www.politico.com/news/2020/04/20/irs-tax-refund-delays-snail-mail-193786

The IRS says as of an update today "Paper Tax Returns: All taxpayers should file electronically through their tax preparer, tax software provider or IRS Free File if possible. The IRS is not currently able to process individual paper tax returns. If you already have filed via paper but it has not yet been processed, do not file a second tax return or write to the IRS to inquire about the status of your return or your Economic Impact Payment. Paper returns will be processed once processing centers are able to reopen. This year, more than 90% of taxpayers have filed electronically."

https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

SWBTATTReg

(25,131 posts)your filed tax returns (w/ state too). I don't pay attention to dates, being that the IRS seems to have their own minds as to when stuff gets done. I got my state refund just a week or so ago (filed really early this year), and nothing really heard yet from the IRS (a small refund too).

If you have requested electronic filing of refund(s) of your amounts from the tax agencies (state too), you'll have an electronic means (vs. the mail) of verifying if and when the returns (and $ amounts come into your checking/savings accounts).

If you're handling via the mail all paper returns, then you'l have somewhat of an iffy time frame (in my experience as a tax person) being that paper returns are being handled by both the IRS/state tax authorities and the US mail.

Who knows exactly what issues they're having with the CV?

I don't know for sure, but they may be kind of swamped w/ the tax stimulus checks going out recently so this may be throwing a bug into the works. From what I've heard, they had to call people back in (the IRS), but I could be wrong.

Good luck.