Economy

Related: About this forum'Catastrophically bad' inflation report is boosting chances of a 75-basis-point interest-rate hike

‘Catastrophically bad’ inflation report is boosting chances of a 75-basis-point interest-rate hike next week

Last Updated: June 10, 2022 at 1:30 p.m. ET

First Published: June 10, 2022 at 12:00 p.m. ET

By Vivien Lou Chen

Friday’s consumer-price index report for May — which showed the annual headline U.S. inflation rate climbing to 8.6% in May, with few signs of having peaked — is boosting the chances of a jumbo-sized rate increase by monetary-policy makers as soon as next week, and eliciting dire warnings that central bankers have completely lost control of prices.

Fed funds futures traders now see a 21% chance of a 75-basis-point hike in June, up from just 3.6% on Thursday, according to the CME FedWatch Tool. Economists at Barclays BARC, -3.69% and Jefferies backed up the shifting expectations, by indicating they expect policy makers to deliver a hike of that magnitude at their June 14-15 meeting.

Beneath the issue of where the Fed goes from here is a much more fundamental and serious problem: Some observers fear the U.S. central bank has already effectively lost control of inflation. May’s price gains were broad-based — hitting everything from shelter to gasoline and food, as well as the narrower gauge, the so-called core reading, that excludes food and energy. The data were “catastrophically bad” for both the Fed and Americans, said Nancy Tengler, chief executive and chief investment officer of Nashville-based Laffer Tengler Investments, which oversees $1.1 billion.

{snip}

Below is a roundup of the reaction to Friday’s CPI data:

{snip}

bucolic_frolic

(46,994 posts)on raising interest rates. They knew 10 months ago, but they dragged their feet on tightening, on bond purchases. They left themselves painted into a corner with nothing but poor choices.

at140

(6,132 posts)I will be shocked if Powell has the balls to push for anything higher than 0.5% rate increase.

CentralMass

(15,538 posts)mahatmakanejeeves

(60,949 posts)peppertree

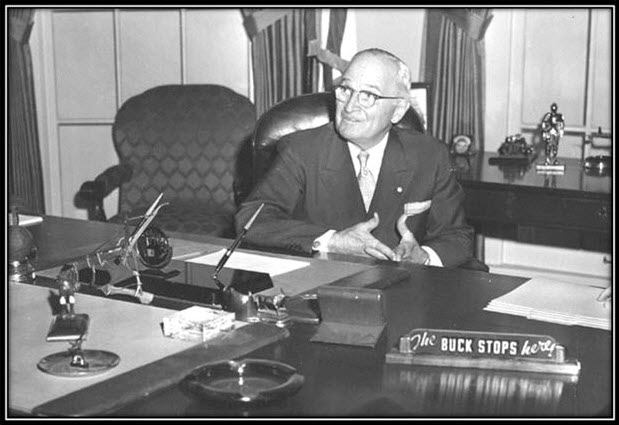

(22,850 posts)"The buck stops here - so leave'em right here if you want anything done, capisce?"

progree

(11,463 posts)from 6.2% year over year in April (April '22 over April '21), to 6.0% year over year in May (May '22 over May '21).

at140

(6,132 posts)Common household purchases continue to be significantly more expensive than a year ago. Food prices increased to 10.1%, the first increase of 10% or more since the period ending in March 1981.

progree

(11,463 posts)And in March, April, and May, the 12 month increases were 10.0%, 10.8%, and 11.9% respectively

Food at home, BLS data series: https://data.bls.gov/timeseries/CUSR0000SAF11

Click on "More Formatting Options" (upper right), and then check the boxes

[v/] Original Data Value

[v/] 1 month Percent Change

[v/] 12 month Percent Change

Check the other percent change boxes as one wishes

Change the date range as one wishes

The purchasing power of my FIXED DOLLAR annuity is melting away.

at140

(6,132 posts)There was a time when I could not carry $25 worth of groceries in my arms.

Now $100 worth of groceries I can carry.

Am I getting stronger in my senior years?

Chainfire

(17,757 posts)If Republicans win big during the mid-terms things will suddenly, just like magic, improve, and show the people that it is only Republicans that can save their pocketbooks.

As a retired person, inflation is my biggest fear. It has already wiped out a significant percentage of the value of my life savings. Unlike previous inflationary periods I will not have a chance to recover after it ends.

Scrivener7

(52,744 posts)at140

(6,132 posts)to buy stocks with 75% of my retirement funds & savings. I expect a further huge drop in stocks during 2022. Hoping 2023 will then be a good year for stocks recovery, and I can make a profit to help with inflation.

Chainfire

(17,757 posts)In fact, I enjoy a good game of poker. When I play poker, I get to open the new deck of cards, shuffle the deck, cut the cards, observe the deal, bet according to what I see, and I get to see the winning hand. I see who was the winner, and if I lose, I know why. If I could just quit drawing to inside straights...

I left some of my money in an investment account and have watched in go up and down like an elevator. I would rather hide the bulk of my savings under the mattress than to give it over to brokers. At least under the mattress, it can't be wiped out in a panic. And before someone freaks out, no, I don't literally keep the bulk of my money under the mattress, but at the rate of return on a savings account, it just as well be.

at140

(6,132 posts)and sell when everyone else is buying.

Works better than any other method I have tried.

I expect some heavy selling to continue in 2022.

Time to buy.

Get Me Outta Here

(97 posts)…savings bonds are now paying 9.62%!

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

peppertree

(22,850 posts)He was, of course, Carter's inflation czar. - and like today, ballooning corporate profits were partly to blame (at least through '79).

x

x