Lessons from the biggest business tax cut in US history

From phys.org

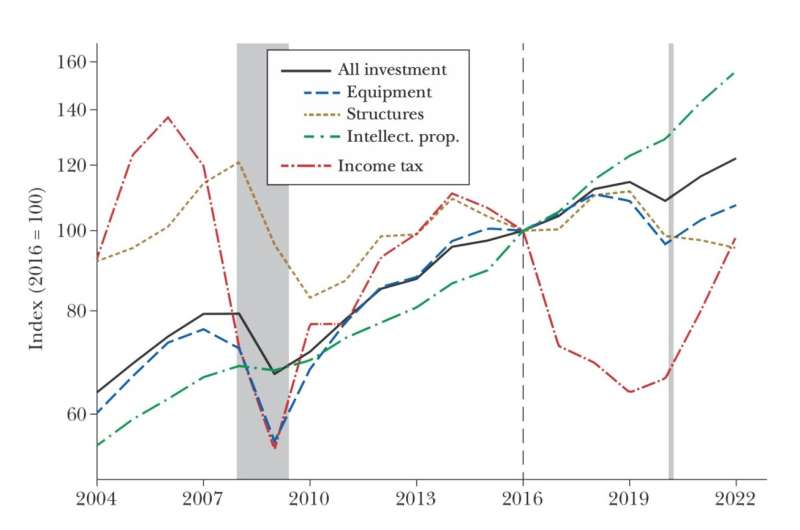

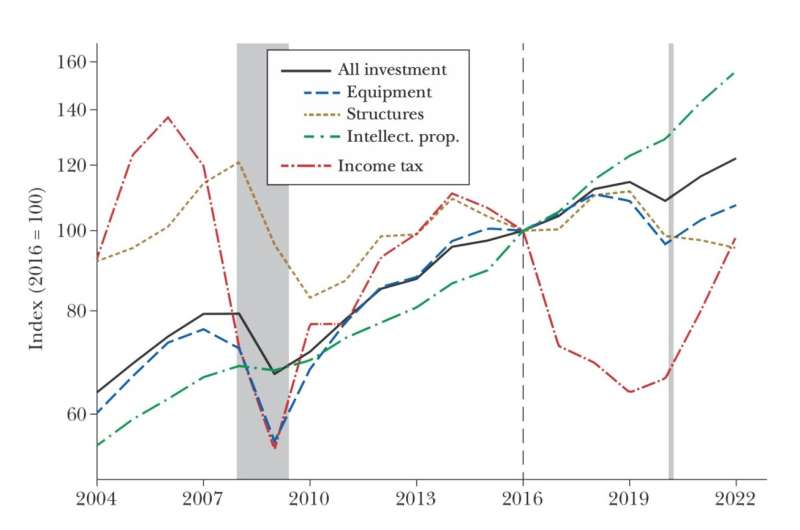

Corporate income tax revenue and investment around the Tax Cuts and Jobs Act of 2017. Credit: Journal of Economic Perspectives (2024). DOI: 10.1257/jep.38.3.61

________________________________________________________________________________________

Congress is spoiling for a tax battle in 2025. Key parts of the 2017 Tax Cuts and Jobs Act are set to expire. Most urgent to many voters are sunsetting provisions aimed at households, including the more generous Child Tax Credit. But renewing the law's deep cuts to corporate taxes are also up for debate.

Republicans and Democrats have seized on the issues in campaign speeches, with Kamala Harris endorsing a higher top corporate rate to pay for other initiatives and Donald Trump arguing that lowering rates further will foster growth.

In a new analysis of the TCJA,

published (open 29 page paper - free download available at the link - Jim) last month in the Journal of Economic Perspectives, Harvard macroeconomist Gabriel Chodorow-Reich charts the real-world impacts of the 2017 law's various corporate tax cuts.

His paper, co-written with Princeton's Owen M. Zidar and the University of Chicago's Eric Zwick, M.A. '12, Ph.D. '14, describes modest increases in wages and business investments, with some expired and expiring provisions proving most cost-effective. But these gains were hardly large enough to offset the big hit to tax revenue.

more ...